Oracle EBS General Ledger Essentials – Question Bank

Oracle E-Business Suite 12.1 General Ledger Essentials – Sample Questions

These questions are similar to the ones asked in the actual Test.

How should I know? I know, because although I got my GL Certification five years back, I have re-certified with the latest version of the Certification test.

Before you start here are some Key features of the GL Essentials Certification Exam

– The exam is Computer based and you have 150 minutes to answer 80 Questions.

– The Questions are (mostly) multiple choice type and there is NO penalty for an incorrect answer.

– Some of the Questions may have more than one correct answers. You must get ALL the options correct for you to be awarded points.

– The Official Pass percentage is 60% (But this can vary). You will be told the exact passing percentage before your begin your test.

Here are a few sample questions for you;

Sample Questions

Q1. The following General Ledger steps do NOT need to be completed before you can use the Accounting Set up Manager

a. Define a chart of accounts

b. Define an accounting calendar

c. Enable currencies

d. Assign secondary ledger

Answer; d

Explanation;

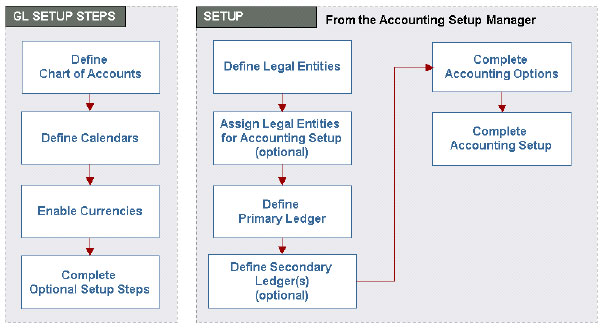

Before you can use Accounting Setup Manager, you must complete the required General

Ledger setup steps. At the very least, you must:

- Define a chart of accounts

- Define an accounting calendar

- Enable currencies

Creating an accounting setup consists of the following steps:

- Define Legal Entities. If you are not integrating with Oracle sub-ledgers or are defining an accounting setup that does not require a legal entity context, then you can skip this step.

- Assign none, one or multiple legal entities to an accounting setup.

- Define a primary ledger by specifying a name, chart of accounts, calendar, currency, and optionally a sub-ledger accounting method.

- Optionally assign one or more secondary ledgers. Secondary ledgers can differ from the primary ledger in any or all of the following:

– Chart of accounts

– Calendar

– Currency

– Sub-ledger Accounting Method

- Optionally, you can create reporting currencies and assign to the primary and/or the

secondary ledger if you want to maintain multiple currency representations.

- Complete the Accounting Options by specifying the journal processing options and

transaction processing options for the setup components in this accounting setup.

- Mark the accounting setup complete. This will prevent certain changes to your accounting

setup and launch the GL Accounting Setup Program that will make your setup components ready for data entry.

Steps in Accounting Setup

Q2. Which of the following are pre-requisites for assigning operating units to a primary ledger in the Accounting setup Manager?

a. Define legal entities and assign them to accounting setups

b. Define sub-ledger accounting methods

c. There are no pre-requisites

d. Complete sub-ledger setup steps

Answer; a

Explanation;

You can assign operating units to the primary ledger to partition subledger transaction data when multiple operating units perform accounting in the context of one or more legal entities.

If using an accounting setup that has legal entities assigned, the Operating Units step will be displayed. The status for this step will be Not Started.

You can update the Operating Units step at any time from the Accounting Options page. You do not have to complete this step to complete your accounting setup.

Note: If you defined operating units in the Define Organization window in Oracle HRMS, then those operating units will be automatically assigned to the appropriate primary ledger in Accounting Setup Manager.

Prerequisites

The following prerequisites are required if you plan to assign operating units to a primary ledger in the Accounting Setup Manager:

- Define legal entities and assign them to accounting setups

- Complete primary ledger setup steps

Note: Once you add an operating unit to a primary ledger, you cannot remove it. You can prevent the use of that operating unit by not assigning it to a Security Profile in Oracle HRMS.

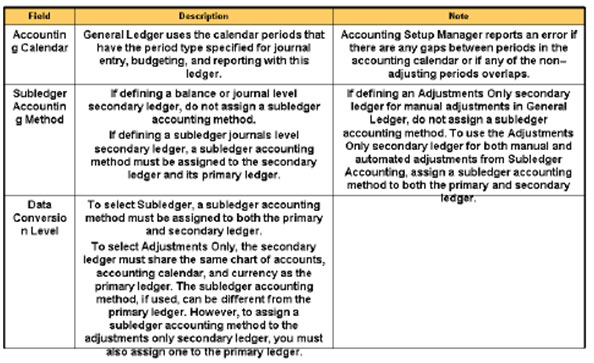

Q3. Secondary ledgers may be used for supplementary purposes, such as consolidation, statutory reporting, or adjustments for one or more legal entities within the same accounting setup.

Secondary ledgers may be maintained at different conversion levels.

Which of the following is NOT a valid conversion level for secondary ledger.

a. Sub-ledger Level Secondary ledgers

b. Journal Level Secondary ledgers

c. Balance Level Secondary ledgers

d. Tax Level Secondary ledgers

Answer: d

Explanation;

Secondary ledgers represent the primary ledger’s accounting data in another accounting

representation that differs in one or more of the following ways:

- chart of accounts

- accounting calendar/period type combination

- currency

- sub-ledger accounting method

- ledger processing options

Use secondary ledgers for supplementary purposes, such as consolidation, statutory reporting, or adjustments for one or more legal entities within the same accounting setup.

For example, use a primary ledger for corporate accounting purposes that uses the corporate chart of accounts and subledger accounting method, and use a secondary ledger for statutory reporting purposes that uses the statutory chart of accounts and subledger accounting method.

This allows you to maintain both a corporate and statutory representation of the same legal entity’s transactions in parallel.

The following conversions are possible;

Subledger Level Secondary Ledgers

The subledger level secondary ledger maintains an additional accounting representation of the subledger journals, journal entries, and balances. The subledger level secondary ledger is maintained using both Subledger Accounting and the General Ledger Posting program.

Journal Level Secondary Ledgers

The journal level secondary ledger is an additional accounting representation of the primary ledger journal entries and balances. This type of secondary ledger is maintained using the General Ledger Posting Program only.

Balance Level Secondary Ledgers

The balance level secondary ledger only maintains the primary ledger balances in another accounting representation. To maintain balances in this type of secondary ledger, use General Ledger Consolidation to transfer the primary ledger balances to this secondary ledger.

Adjustments Only Secondary Ledger

The adjustments only secondary ledger is an incomplete accounting representation that only holds adjustments, manual adjustments, or automated adjustments created by Subledger Accounting.

Q4. Which of the following statements are FALSE regarding adding/deleting/disabling Secondary Ledgers?

a. To add a Secondary Ledger, the ledger options for the primary ledger must be completely defined

b. You can only delete secondary ledgers before the accounting setup is complete.

c. Once you disable the conversion of secondary ledgers, it immediately prevents the propagation of journals from the primary ledger to the secondary ledger.

d. The disabled secondary ledger is no longer available for historical reporting and manual journal entries.

Answer; d

Explanation;

Adding, Deleting, Disabling Secondary Ledgers

Adding Secondary Ledgers

Add secondary ledgers to accounting setups at any time in the Accounting Options page.

If you add a balance level secondary ledger that uses a different currency from the primary ledger, a balance level reporting currency is generated for the primary ledger unless one already exists. This balance level reporting currency maintains the primary ledger’s translated balances and is the source representation for the secondary ledger. In other words, when using GL Consolidation to transfer balances to the secondary ledger, transfer the balances from the source representation, the balance level reporting currency.

Prerequisite

The ledger options for the primary ledger must be completely defined.

To add secondary ledgers:

- Open the Accounting Options page.

- Select Add Secondary Ledger. This button will only appear after the ledger options for the primary ledger have a complete status.

- Enter all relevant fields.

Note: After adding a secondary ledger, complete the Ledger Options step and the Primary to Secondary Ledger Mapping step to enable the secondary ledger for data entry.

Deleting Secondary Ledgers

You can only delete secondary ledgers before the accounting setup is complete. After the accounting setup is complete, you can disable the conversion of secondary ledgers. This prevents any journals that are entered in the primary ledger or source representation from being transferred to the secondary ledger.

Deleting a secondary ledger removes the ledger and all of its setup steps.

To delete secondary ledgers:

- Navigate to the Accounting Options page.

- Find the secondary ledger to delete and click the Remove Secondary Ledger icon.

Disabling the Conversion of Secondary Ledgers

Once you disable the conversion of secondary ledgers, it immediately prevents the propagation of journals from the primary ledger to the secondary ledger.

The disabled secondary ledger is still available for historical reporting and manual journal entries.

Notes:

- Balance level secondary ledgers cannot be disabled. To stop transferring balances from the source representation (primary ledger or balance level reporting currency) to the balances level secondary ledger, stop running consolidations.

- Adjustments only secondary ledgers cannot be disabled because journals are not automatically transferred to this secondary ledger.

To disable the conversion of secondary ledgers:

- Open the Accounting Options page.

- In the Secondary Ledgers region, select the Disable Conversion icon for the secondary ledger to be disabled.

Note: Once the conversion of a secondary ledger is disabled, the status of the secondary ledger is changed to Disabled.

Q5. Recurring Journals may be defined for transactions that repeat every accounting period, such as accruals, depreciation charges, allocations etc.

Which of the following Recurring Journal types will allow you to calculate the rent expense based on end-of-month headcounts?

a. Skeleton Journals

b. Formula Journals

c. Calculator Journals

d. Standard Journals

Answer; b

Explanation;

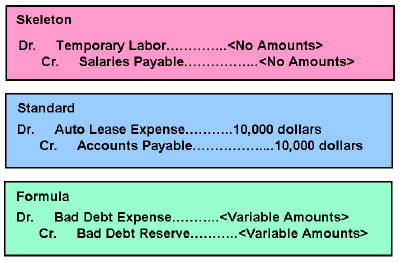

The three major types of Recurring Journals are shown below;

Skeleton Journals

- Skeleton journals have varying amounts in each accounting period. You define a recurring journal entry without amounts, then enter the appropriate amounts each accounting period.

- There are no formulas to enter, only account combinations. For example, you can record temporary labor expense in the same account combination every month with varying amounts due to fluctuations in hours.

Standard Journals

- Standard journals use fixed account combinations and amounts each accounting period.

- You enter a journal using constants. For example, record monthly auto lease expenses with constant amounts charged to the same account.

Formula Journals

- A formula entry is a recurring entry that uses formulas instead of amounts to calculate amounts.

- For example, calculate rent expense based on end-of-month headcounts.

More Questions? Have a look at: